Grape Expectations: In Napa Valley, Winemaker’s Brands Divide an Industry

‘Two-Buck Chuck’ Maker Owns Labels Based in Region; Vineyards Are Elsewhere — An Appeal to Supreme Court

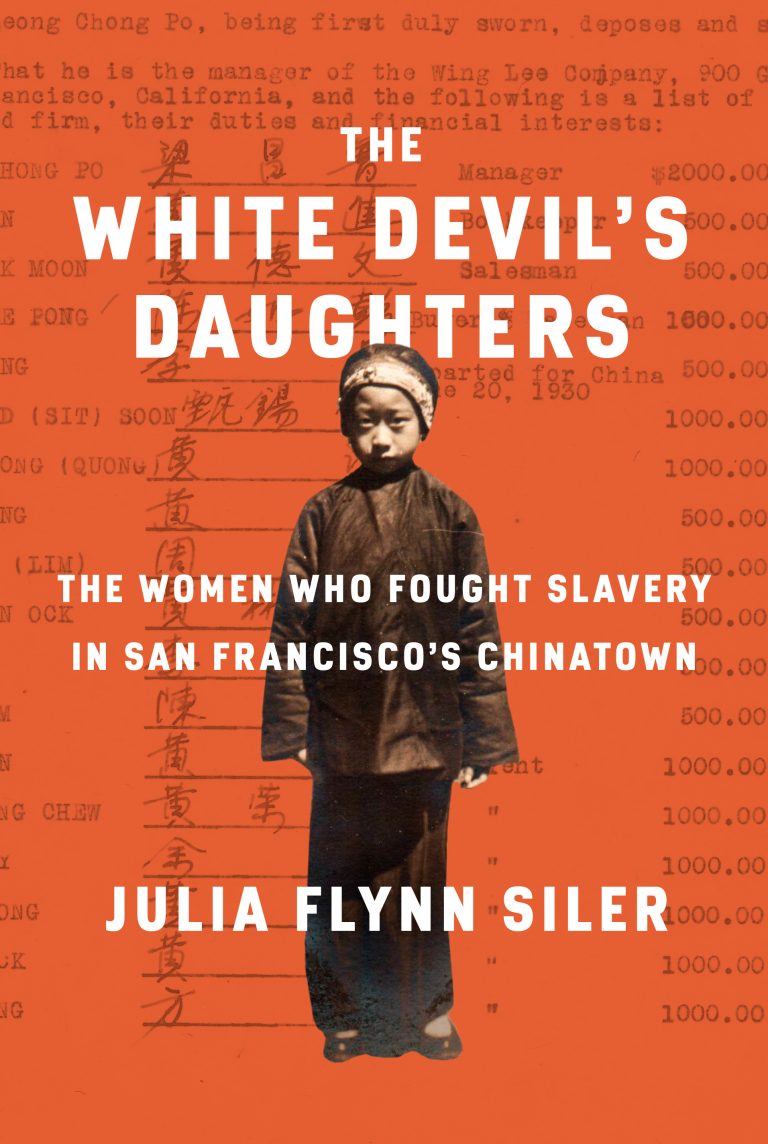

By Julia Flynn Siler

CERES, Calif. — Fred T. Franzia defied the U.S. wine industry three years ago by proving he could offer a decent bottle of wine for under $3. The wine, sold through Trader Joe’s Co. stores and nicknamed “Two-Buck Chuck,” was an instant success for his Bronco Wine Co.

Mr. Franzia, 61 years old, hasn’t stopped tilting at the wine establishment. Now he’s selling wine under labels he acquired from companies based in Napa Valley that are strongly associated with particular places there. But while the previous owners mostly made wine from Napa grapes, Mr. Franzia is using produce from outside the world-famous region. In fact, the Franzia family, despite being one of California’s largest grape growers, owns no Napa vineyards. Napa rivals say the practice is misleading and will sully the special reputation of their wines. California law largely forbids such labeling.

For more than four years, Mr. Franzia has waged a battle with state regulators and Napa winemakers seeking to validate his sale of Napa-brand wines that don’t contain Napa grapes. Rebuffed by California’s highest court last year, Mr. Franzia last month filed a petition with the U.S. Supreme Court, asking it to rule that federal law supports his position and trumps state regulations. His attorneys expect the court to decide this spring whether or not to take the case.

Mr. Franzia says the fight is no longer just about business. “It’s become a manhood issue,” he says.

The outcome will help determine the character of the $22 billion U.S. wine industry. If the Napa vintners prevail, it could grow to resemble the clubby French wine scene. There, winemakers fiercely guard the rights to use certain geographical place names, known as appellations, which determine their position in the wine hierarchy, and imply, often for centuries, an assurance of quality. If Mr. Franzia wins, a more freewheeling and commercial ethic could prevail. Successful vintners may not be drawn from the ranks of well-known names, but rather those able to offer low prices.

Napa’s winemakers have lined up against Mr. Franzia. They sought and won support from an influential French wine association. On the other side, Mr. Franzia is backed by small vintners from other U.S. wine regions fighting similar battles. More than 60 wineries in 18 states filed a brief with the Supreme Court last week supporting his petition.

Already, the snit has become personal. Mr. Franzia’s opponents are making hay from Mr. Franzia’s 1993 guilty plea to a charge of passing off cheap grapes as a more expensive variety. “Fred’s business practices leave a lot to be desired,” charges Tom Shelton, president of the upscale Napa winemaker Joseph Phelps Vineyards.

Mr. Franzia calls the Napa vintners a “bunch of whiners” living in a “fantasy land.” He says that under federal law, he has the right to use whatever grapes he wants as long as their origin is noted somewhere on the label. As for the 1993 indictment, Mr. Franzia says it was instigated by rivals irked by his business tactics. “I don’t think they dislike me as much as they’re jealous of our success,” he says.

Bronco is owned by Mr. Franzia along with his brother Joseph and cousin John G. Franzia Jr. It’s based in Ceres, a town located in California’s Central Valley, an agricultural region separated from Napa’s picturesque wineries by low mountains. Bronco’s unmarked headquarters is surrounded by a chain-link fence topped with barbed wire.

Bronco anchors a network of closely held vineyards, wineries and distributors owned primarily by the Franzia family. Most vintners tend to own a token acreage. Mr. Franzia, who is Bronco’s chief executive, has been quietly buying up chunks of Central Valley farmland and now owns or controls upward of 30,000 acres. While there are no official data available, the California Grape Growers’ Association believes he is the largest grape producer in California.

In 2001, he opened a vast bottling plant and winery on the outskirts of the town of Napa that can churn out 216 million bottles a year — twice the annual average produced by all Napa-based wineries. For the year ended June 30, Bronco had $300 million to $350 million in sales of bottled wine, says Mr. Franzia. It also makes money bottling and distributing wine for other wineries and selling nondescript wine and grapes in bulk. Mr. Franzia won’t reveal the profits of his family’s companies or his own net worth.

Mr. Franzia’s commercial clout is mirrored by his outsize personality. The nephew of wine mogul Ernest Gallo, he is prone to blunt talk studded with profanities that rubs rival vintners the wrong way. At one industry event, Dennis Groth, co-owner of Napa Valley’s Groth Vineyards & Winery, recalls Mr. Franzia asking him to “think of me as a buzzard, swooping over the Napa Valley looking for some little carcass to pick up.” Mr. Franzia doesn’t recall the details of that conversation but says he probably made such a statement.

The Franzia family began growing grapes in California in 1892 and making wine in 1933 after the repeal of prohibition. But the current generation of Franzias didn’t inherit the business from their parents. In 1973, Mr. Franzia’s father and uncle sold their operation to Coca-Cola Bottling Co. of New York. As part of the deal, the Franzias were barred from using their name in new winemaking ventures. (The Franzia name remains on boxed wines unconnected to the family.)

Mr. Franzia, who was 30 at the time, tried to persuade his father not to sell. “Our parents didn’t think we were ready to run the winery,” he recalls. Bitter over the snub, Mr. Franzia formed a company with his brother and cousin in 1974 and named it Bronco after the mascot of his alma mater, Santa Clara University.

Without any vineyards, Bronco started buying and selling bulk wine used to make table wines. This bulk wine is still bought by some of the region’s most storied vineyards — including those currently fighting Mr. Franzia — who combine it with their own grapes. Under local regulations, winemakers can add up to 25% of lesser-quality produce to their mix without having to change their labeling.

Mr. Franzia’s first big hit as a distributor was the Glen Ellen brand, produced by Benziger Family Winery, which was sold by California supermarkets for less than $5 a bottle. By the late 1980s, Glen Ellen dominated its category.

The family started buying its own wine brands in the early 1990s when it lost the distribution contracts for Glen Ellen and Robert Mondavi Corp. Both wineries dumped the Franzias for distributors with more muscle.

Then Mr. Franzia ran into legal trouble. In 1993, a federal grand jury indicted Bronco and Mr. Franzia on conspiracy-to-defraud charges in U.S. District Court in Sacramento. The indictment charged them with passing off crushed grapes costing between $100 and $200 a ton as zinfandel grapes worth 10 times that amount.

To avoid detection, according to the indictment, Mr. Franzia scattered zinfandel leaves on top of non-zinfandel grapes as they lay in bins waiting to be crushed. According to the charges, Mr. Franzia called this “the blessing of the loads,” as in “truckloads,” a parody of the wine industry’s tradition of blessing the harvest.

Bronco pleaded no contest and paid a $2.5 million fine. Mr. Franzia pleaded guilty and paid a $500,000 fine. He was banned for five years from sitting on Bronco’s board and holding a formal position with any wine business. “I was the head of the family, so I took the hit,” says Mr. Franzia. He says he pleaded guilty to protect seven other Bronco employees threatened with indictment.

Under the terms of his plea, Mr. Franzia was allowed to work on Bronco’s finances from his home. The Franzia companies stepped up their buying of Napa wine brands, acquiring Napa Ridge, Napa Creek Winery and the Rutherford Vineyards brand. Rutherford is a well-known part of Napa that’s famous for its grapes.

The companies that owned Napa Creek and Rutherford Vineyards used mostly Napa grapes to make their wine. Napa Ridge, however, was made with non-Napa grapes, something Mr. Franzia likes pointing out to his current critics. Mr. Franzia’s companies extended that practice to all its Napa brands and began using grapes grown in Central Valley and California’s Coastal regions.

Bronco’s advertising campaign for Rutherford seemed to thumb its nose at the whole concept of “terroir,” the idea that a particular place imbues a wine with distinct character. “It’s not the hill . . . It’s not the state . . . It’s not the ranch . . . And it’s certainly not the dust. It’s the vineyards!” the ad asserted.

The ad featured a photograph of a winery located in the heart of Napa. The mistake was unintentional, says Mr. Franzia, but it still infuriated the Napa establishment. After wrangling in the courts, Bronco withdrew the ad and changed the brand’s name.

Bronco became a national phenomenon in 2002 with its Charles Shaw brand, which Mr. Franzia had acquired seven years earlier at a fire-sale price of $25,000, he recalls. Nicknamed Two-Buck Chuck, it sells exclusively through discount retailer Trader Joe’s for between $1.99 to $3.39 a bottle, and has kicked off a nationwide fad for low-cost wines. The company that previously owned Charles Shaw was based in Napa and used Napa grapes, although that brand isn’t part of the current legal battle because its name isn’t linked to a particular geography.

To the astonishment of some aficionados, Charles Shaw has won praise from critics and awards in competitions and has been America’s fastest-growing wine brand by volume over the past two years, according to Gomberg, Fredrikson & Associates, a wine consultant. While California sales have slowed recently, Charles Shaw’s sales in other states are growing.

Its success helped pull the industry from an inventory glut that began three years ago. Last year, a record 277.8 million cases of wine were sold in the U.S., up 2.7% from the previous year, according to Gomberg Fredrikson. At this pace, the U.S. is on track to overtake France and Italy as the top wine-consuming nation in the world within a decade.

At the same time, Two-Buck Chuck has hurt some winemakers and the industry is rapidly consolidating. Consumers quickly learned to trade down to the $2 or $3 price of Bronco’s wine. Australian winemakers also have made big inroads into the $6 to $9 segment of the U.S. market.

As Mr. Franzia’s success swelled, Napa began to mobilize against him. A group of Napa vintners successfully lobbied California’s state legislators to pass a law in 2000 requiring wines using the Napa name to consist of at least 75% Napa-grown grapes.

Mr. Franzia’s critics say filling Napa-labeled bottles with non-Napa wine is deceptive and gives Mr. Franzia an unfair price advantage. Cabernet grapes from the Central Valley sell for about $250 a ton; those from Napa sell for around $4,000 a ton.

“From a business perspective, it’s obviously brilliant,” says Jeff Gargiulo, co-owner of Gargiulo Vineyards in Napa Valley and CEO of Sunkist Growers Inc., an orange-growers cooperative. “But from an

ethical perspective, he’s misleading consumers.”

Mr. Franzia responded in December 2000 by filing suit challenging the constitutionality of California law. At Bronco’s initiative, the suit went straight to the state appeals court. Bronco contended that federal law expressly permits “geographically misdescriptive” brand names if they were in use before July 7, 1986, when new federal regulations were passed, as long as the grapes’ origin is described somewhere on the label. The court of appeal ruled in Mr. Franzia’s favor.

In August 2004, the California Supreme Court reversed that decision and ruled unanimously in favor of the Napa vintners. It said federal law didn’t pre-empt state law in regulating wine labels. The court sent the case back to the appellate court to rule on Bronco’s remaining claims. Mr. Franzia’s legal team decided not to wait and asked the U.S. Supreme Court to intervene. The court is currently hearing an unrelated case relating to sales of wine across state lines.

The Napa Valley Vintners, a trade group that represents 263 wineries, has won support from France’s Comite Interprofessionnel Du Vin De Champagne. The group fiercely guards the use of the term “champagne” and has battled producers from outside the region who have tried to co-opt it.

“The lesson we learned from what happened in Champagne is that you have to fight for the name,” says Richard P. Mendelson, a lawyer representing the Napa group.

Instead of galvanizing the industry against Mr. Franzia, the battle has created a divide. Vintners in some other states are permitted to sell wine associated with certain regions made from grapes harvested elsewhere. Seeking to forestall the passing of California-style labeling laws in their markets, they’re pushing for the creation of a consistent national standard.

More than 68 wineries and 48 grape growers signed a “friend of the court” brief with the California Supreme Court supporting Mr. Franzia. They included Korbel Champagne Cellars and Don Sebastiani, based next door to Napa in Sonoma Valley. Many of the same winemakers joined the brief on Bronco’s behalf with the U.S. Supreme Court.

Mr. Franzia, meanwhile, is charging ahead. He wants restaurants to offer his Napa-labeled wine for under $10 a bottle. He says he’s trying to ink contracts to sell “extreme value” wines at chains including Wal-Mart Stores Inc. and Costco Wholesale Corp.

“The Napa Valley Vintners are begging for a fight,” he says.